OpenAI and Microsoft have issued a joint statement today, simultaneously published on their respective official websites, addressing the ongoing restructuring negotiations that are critical to the future of the artificial intelligence powerhouse. The identical statements, with only a slight variation in the order of the primary subject at the opening, underscore the gravity of the situation and the aligned messaging between the two entities.

Microsoft’s official announcement can be found here: https://blogs.microsoft.com/blog/2025/09/11/a-joint-statement-from-microsoft-and-openai/

Microsoft’s official announcement can be found here: https://blogs.microsoft.com/blog/2025/09/11/a-joint-statement-from-microsoft-and-openai/

OpenAI’s official announcement is available at: https://openai.com/index/joint-statement-from-openai-and-microsoft/

OpenAI’s official announcement is available at: https://openai.com/index/joint-statement-from-openai-and-microsoft/

While the specifics of the cooperation memorandum remain undisclosed, it is crucial to note that this agreement is non-binding, indicating that a final definitive partnership treaty has yet to be ratified by both parties.

The ongoing discussions have not gone unnoticed by the wider tech community, with a Reddit user’s commentary reflecting the public’s varied interpretations of the news:

The implications of these negotiations—whether positive or negative—depend heavily on one’s perspective.

OpenAI Elaborates on Structural Reorganization

In addition to the joint statement, OpenAI has appended a separate announcement to its release, providing further context on its organizational plans.

This announcement is accessible at: https://openai.com/index/statement-on-openai-nonprofit-and-pbc/

This official release suggests OpenAI is strongly asserting its desire for control over its ultimate corporate structure. Currently, OpenAI operates under a “capped-profit” model. Its parent company is a non-profit organization (OpenAI Inc.), which oversees a for-profit subsidiary (OpenAI Global LLC). Under this structure, investors are limited to a fixed return multiple, precluding long-term equity and the possibility of an Initial Public Offering (IPO).

OpenAI is reportedly seeking to restructure in a manner that would allow external investors to hold actual equity in the company, paving the way for a future IPO, while also fulfilling its responsibilities to stakeholders like Microsoft. Concurrently, a new entity, OpenAI PBC, is envisioned to become one of the world’s most heavily resourced philanthropic organizations, potentially valued in the hundreds of billions of dollars.

However, the Wall Street Journal has reported that the Attorneys General of California and Delaware are investigating OpenAI to ensure its proposed plans do not contravene charitable laws.

Source: https://www.wsj.com/tech/ai/openai-for-profit-conversion-opposition-07ea7e25?mod=article_inline

OpenAI maintains that these structural changes are ultimately aimed at ensuring Artificial General Intelligence (AGI) benefits all of humanity.

The protracted negotiations between OpenAI and Microsoft over restructuring and the rewriting of their partnership agreement have been intense, with the final outcome still pending. Since OpenAI accepted significant investment from Microsoft, their respective interests have often been at odds. Key points of contention in these prolonged discussions have included the hosting of OpenAI’s services across multiple cloud providers, the ownership of OpenAI’s intellectual property, and, most critically, control over AGI development.

Previous analyses have detailed the divergences in their demands:

- [Link to previous article about OpenAI/Microsoft AGI control dispute]

Both Microsoft and OpenAI are urgently seeking clarity on OpenAI’s future trajectory.

Time is Running Out for OpenAI

Several factors are converging to create a critical juncture for OpenAI. Firstly, the end of the year represents a significant deadline, as the progress of these negotiations will determine whether SoftBank’s potential $10 billion investment materializes.

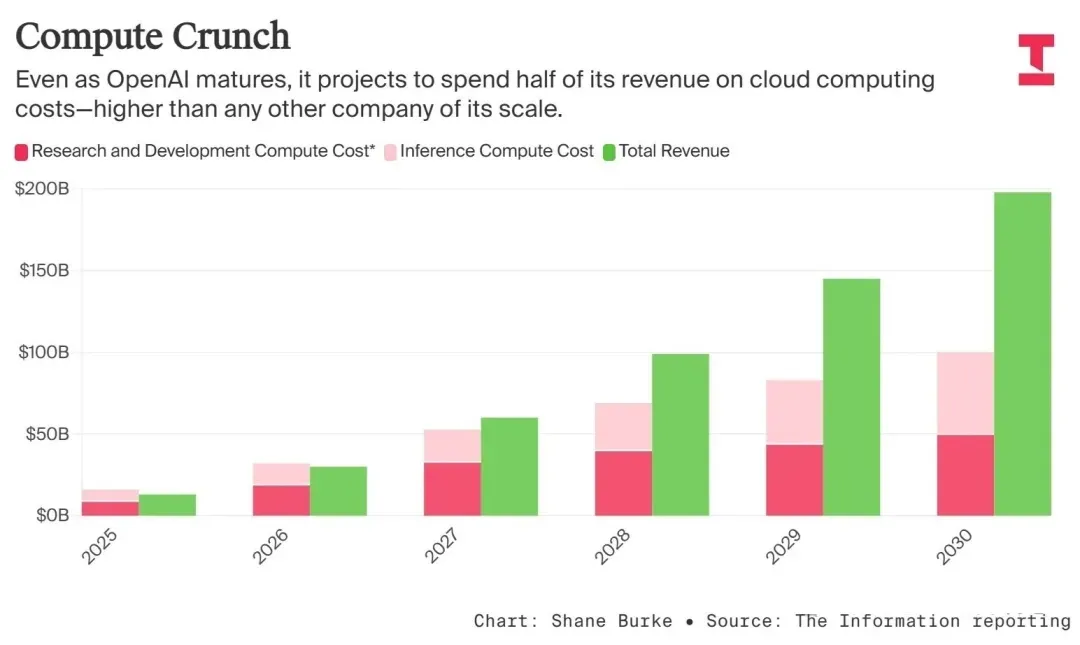

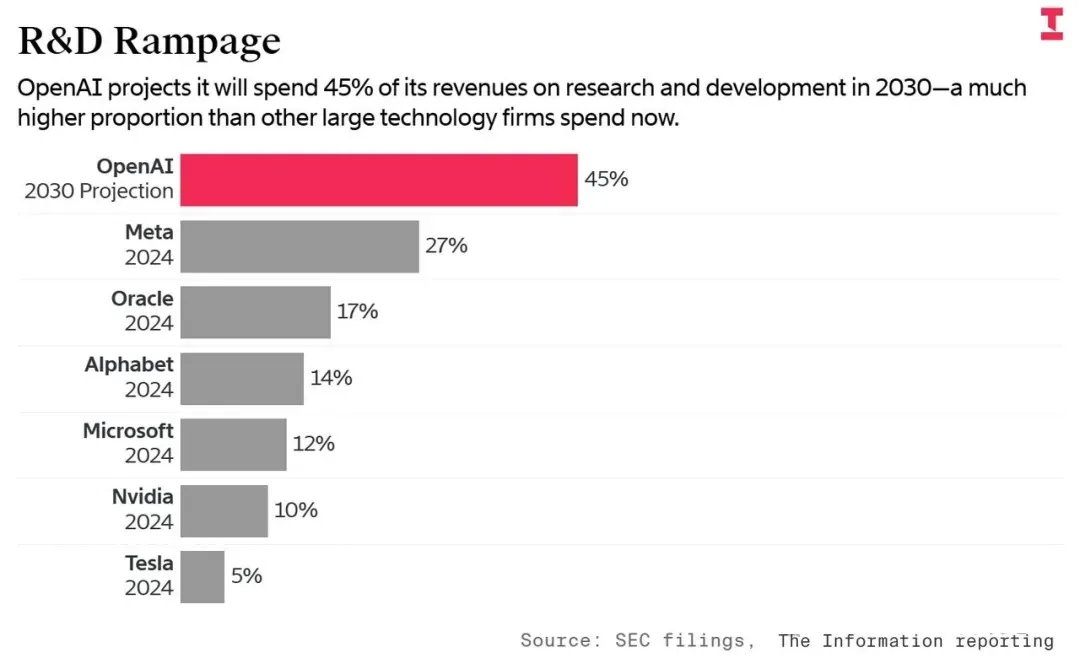

Secondly, OpenAI’s training costs are escalating rapidly with increasing model parameters. In contrast to competitors like Meta, which have aggressively hired talent from OpenAI, OpenAI’s research and development expenses are exceptionally high. Projections indicate that by 2030, these costs could account for nearly half of the company’s total revenue, compared to Meta’s projected quarter.

The company’s ability to achieve profitability amidst these soaring R&D expenditures is a subject of intense scrutiny. Many popular consumer internet services historically incurred losses for over a decade before finding sustainable revenue models. Companies like Amazon, Uber, Netflix, and Snap eventually achieved profitability through price increases, advertising, or the introduction of complementary services, leveraging vast user bases.

OpenAI’s expanding user base, with ChatGPT approaching a billion users and generating approximately $10 billion in revenue from millions of subscribers this year, appears to place it in a similar position. However, with investors valuing OpenAI at an implied $500 billion, the associated risks are as unprecedented as the company’s enormous costs.

Reports have surfaced suggesting OpenAI’s consideration of monetization strategies, such as integrating shopping ads into ChatGPT, which has drawn criticism. The Information has reported that OpenAI plans to burn through $115 billion in cash by 2029.

According to OpenAI’s own projections, its computing and talent expenditures will continue to represent a substantial portion of its revenue for at least the next five years. While the company anticipates generating free cash flow by 2030, its massive spending raises questions about its long-term profitability compared to established public tech companies.

In 2030 alone, OpenAI is projected to spend $100 billion on server rentals for training and operating its models. Furthermore, it is expected to spend an additional $250 billion on cloud server leases prior to 2029, bringing the total expenditure over six years to $350 billion.

This scenario presents a significant boon for OpenAI’s cloud service providers, including Oracle (reportedly set to earn $300 billion from OpenAI alone between 2027 and 2032), Microsoft, CoreWeave, and Google Cloud.

The substantial positive outlook for Oracle’s cloud business has already impacted its stock, which rapidly climbed from a low of $240 per share on September 9th to a high of $343 per share on September 10th. This surge propelled company founder and chairman Larry Ellison to the top of the world’s richest individuals list, temporarily surpassing Elon Musk.

Meanwhile, Sam Altman, OpenAI’s CEO, is unlikely to find much solace. The immense pressure he faces is reportedly causing him significant stress, as highlighted in a recent Fortune article.

The overwhelming cost pressure leaves OpenAI with virtually no room for error in the coming years. The company must exert maximum effort to achieve revenue scales comparable to those of companies like Nvidia and Meta by 2030 simply to ensure its survival.